You’ve already seen MonieWorld’s first tweet, 'From Lagos to London, from Naija to the World,' and DisruptAfrica calling it 'the new UK-focused financial services solution.' But behind the headlines captured in the buzz of social media and press releases, there’s a deeper story rooted in our mission at Moniepoint: financial happiness for every African, everywhere.

I huddled with Ravi, who leads the MonieWorld team; Sulaiman, our Enterprise Architect; Kaushal, who shaped how the money moves from the UK to Nigeria by finding the right payment partners; and Emir, who led onboarding, to get the story of how we took financial happiness global through MonieWorld, our diaspora-focused financial services product. .

Welcome aboard.

Flight plan: assembling the crew

Before MonieWorld had a name, conversations about building a diaspora-focused product were already in the air. Sulaiman, who had previously worked on Moniepoint’s Agency Banking and Moniebook, first heard about the idea in early discussions with Felix. With his background in infrastructure and payments, he began working with Ravi to help shape what would eventually become MonieWorld.

The vision was bold but clear: to create something that felt like home. Having moved to the UK ourselves, we understood what it meant to land in a new country and feel adrift, to carry our culture, our dreams, and our identity, yet still feel invisible in the systems around us. So, we built a financial tool for people like us that offered safety, familiarity, and a deep sense of belonging.

For Ravi, this runs deep. As an immigrant, he remembers arriving in the UK in 2007 and struggling to get a postpaid mobile connection despite his top credentials. The journey of financial democracy for immigrants hasn’t gotten much easier.

With strong leadership in place, a clear vision, and the right internal momentum, we knew the timing was right. The only thing left was to start the build. Every flight needs the right crew. For us, that meant an incredible team of 80 DreamMakers.

The project had to reflect the global nature of the diaspora we were serving, so it wasn't long before we went from ten people in the first quarter to nearly sixty by the end of Q3, drawn from Nigeria, India, Pakistan, Hong Kong, Latin America and the UK, a small mirror of the diaspora we set out to serve.

Despite growing rapidly, the team reflected Moniepoint’s DNA: people deeply aligned with our grit, technical depth, and empathy values.

Securing our flight path

Building for the diaspora meant we couldn't fly solo. We needed strong, trusted partners across banking, payments, open banking platforms, and regulatory frameworks. The flow of money was designed to feel effortless, like sharing it with someone just down the street at home.

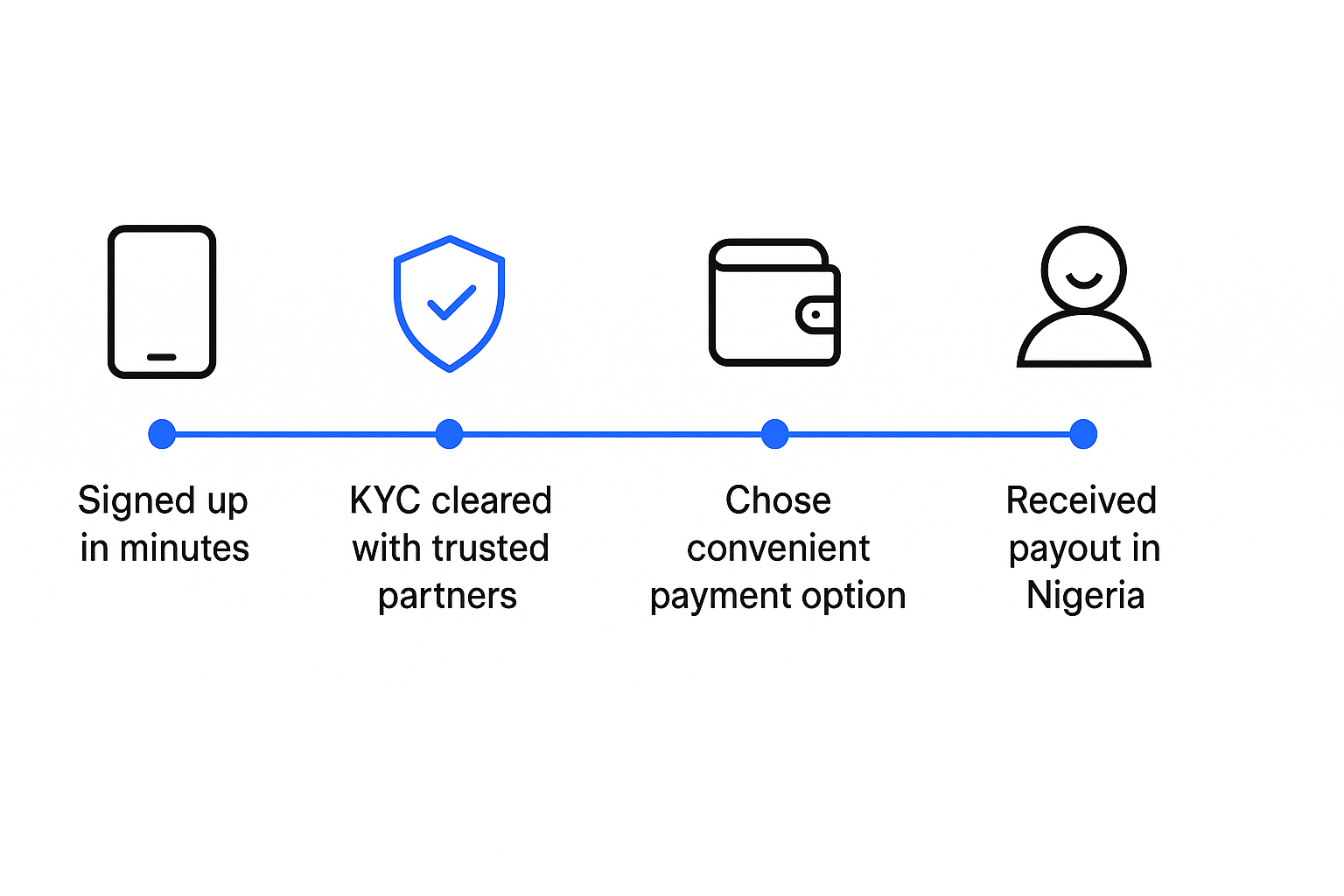

Customers who download the MonieWorld app begin their journey by completing the KYC process. This is where we partner with trusted institutions to ensure a smooth and secure onboarding. Once verified, our customers can start sending money immediately.

We offer multiple payment options to make the process as convenient as possible. Whether through Apple Pay, Google Pay, or Debit/Credit Cards, we’ve got the flexibility to meet our customers' needs. Behind the scenes, we work with key payment and banking partners to ensure these transactions are processed efficiently.

Once we receive the GBP payment, we convert it and facilitate the NGN payouts to our partners in Nigeria. This is where the money moves to the beneficiary, with our vast network of partner banks in Nigeria ensuring the funds are credited swiftly and securely.

The making of this journey wasn’t without turbulence. Kaushal remembers it vividly: "It felt like building a car while racing it down the track, deciding between securing our license, forging partnerships, and adjusting plans in real time."

Building the aircraft

It took us one year from idea to launch. We came together in February 2024, and by April 2025, we were ready to start boarding. Every element was intentionally crafted, from core banking architecture to UX design language. To tell that story properly, I’ll break it into two parts: how we built for performance and designed for people.

Engineering for speed and scale

We didn’t build the app as one giant block of code. Since some parts of the app, such as payments and fraud detection, will be used more frequently than others, we used a microservices architecture. This approach allows us to focus on what’s used most at any given time. It's like building with Lego instead of pouring a concrete slab. You can swap, improve, or scale pieces without touching the whole structure.

One of Monieworld's standout features is speed. It takes seconds to send £1 to a Moniepoint account. We achieved this by streamlining our operations, especially in the UK, eliminating unnecessary blockers. Understanding the flow of money from start to finish allowed us to optimise each step and make it faster. Additionally, we leveraged the existing payment infrastructure in Nigeria, integrating it seamlessly into our platform to ensure smooth, quick transactions.

We created new capabilities to support the complexity of cross-border payments and layered in user experience choices that spoke to the African diaspora and global standards. Take addresses, for example: you ask for an address in the UK and get the postcode. But in Nigeria, the process is far more complex. This difference in verification methods has helped us design a more efficient and straightforward experience for our users, regardless of location.

Sulaiman, who served as Enterprise Architect on MonieWorld, said that when choosing the right technology, we drew from our experience in the Nigerian market, understanding that we needed a solution that could handle a vast customer base. We opted for Java, an enterprise-grade language, alongside Spring Boot for backend development, ensuring a solid and scalable foundation. For our database engine, we selected Google Spanner, a technology that promises future-proof scalability and performance. This decision was driven by the need to support the high-demand milestone we built for.

Designing the flight experience

Another critical piece was the onboarding experience, which Emir led. Customer interviews heavily influenced this process, down to the name "MonieWorld," which reflects a bigger dream: connecting the world while staying rooted at home.

Customers weren’t just early users; they were co-builders. They tested features and shared feedback, and we returned to work, refining until it felt right. One clear example was the home screen. Customers wanted something clean and minimal, without clutter, so we stripped it down to what mattered. That process of listen, tweak, repeat became a blueprint. What emerged wasn’t just a product for our community but one built with them.

The integration of Apple Pay is a customer favourite. However, it wasn’t easy to get it working, especially since Apple Pay is not widely used in the Nigerian ecosystem. We had to bring together people from different payment ecosystems who contributed valuable insights into how best to integrate it. Their knowledge helped us create a solution that works seamlessly for users, making it easier for them to make payments in a way that feels familiar and convenient.

Takeoff and landing

As the launch neared, the entire company rallied. Senior leaders didn’t just green-light features; everyone rolled up their sleeves, tested the product rigorously, and gave thoughtful, personal, and often emotional feedback.

For Sulaiman, building MonieWorld was about repeating history, taking the excellence that helped us simplify payments back home, designing a tool that puts the customer’s lived reality at the centre, and bringing it into diaspora services with the same heart and ambition.

An integral part of takeoff for us is the invite-only feature on MonieWorld. Our invite-only approach wasn’t just about exclusivity; it was about celebrating community. Because if you're an immigrant, as Ravi reminds us, you know: "Before the house, before the job, it's community that keeps you grounded." We wanted our first users to feel like they were stepping into something familiar, built with intention. And we wanted to listen. Every invitation came with open ears to learn what worked, what needed to change, and what would make the experience feel like home. And when users shared their early feedback that it "felt made for us", it was more rewarding than any launch announcement could have been.

The moment finally came in April. MonieWorld launched quietly but with immense pride. Seeing the first transfers and real money reaching real families validated everything we had worked for. Despite speaking with them at different times during the launch, all team members shared this statement.

In the few weeks since MonieWorld launched, over £1m has been moved through the app, and every pound sent home isn't just money going home, it’s dreams made real.

And it’s still day one.

We built a financial tool for Africans in the diaspora that’s fast, secure, and deeply thoughtful in its design. If building meaningful products like this is your kind of vibe, come build with us.